Elite Socialism Has Easy Access Through ESG

Originally published at NewsmaxThe creativity and productivity that are part of American exceptionalism did not happen by chance.

The United States has only 4% of the world’s population and yet it has generated 96% of the world’s creativity and 25% of its wealth. In large part, this has resulted from the U.S. Constitution that has empowered her people and corporations by limiting the prerogatives of government to encumber business and divert talent away from productivity.

But there are a myriad of forces at work within and outside the United States that aim to remake and advance an elite socialist grip on how businesses are governed and how our economy works.

While average Americans are still recovering from the consequences of governments’ misguided lockdown mandates and policies to deal with COVID-19 — that resulted in shortages, roadblocks and failures in global supply chains, skyrocketing inflation, and disruption of the labor force — another more subtle but far-reaching development is gaining momentum behind the scenes.

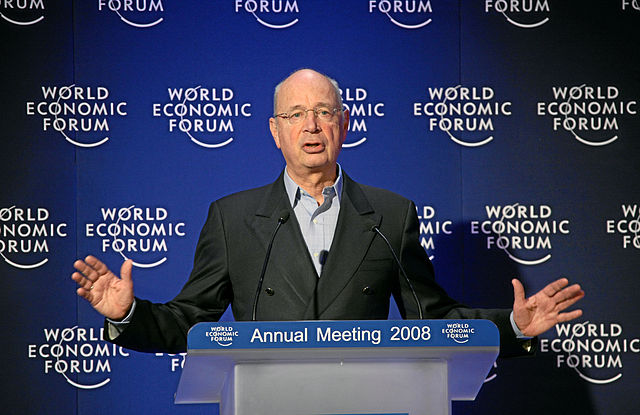

Klaus Schwab’s World Economic Forum (WEF) is famous for its annual Davos gathering. But now with an expanded staff and membership, it meets throughout the year in locations around the world.

WEF has gained notoriety for its pro-China posture and its promotion of the “Great Reset.” Some of the goals of the Great Reset can be seen in WEF productions, such as a video, titled “Eight Predictions for the World in 2030,” which includes an admonition that “you will own nothing. And you will be happy.”

Most people with common sense and a cursory understanding of history recognize that a society in which people own nothing would be a tyranny. Notwithstanding, Schwab has been successful in gaining attendees from governments and corporations throughout the world, bragging about Angela Merkel, Vladimir Putin, Justin Trudeau, Emmanuel Macron and the president of Argentina having been graduates of his “Young Global Leaders Program.”

Schwab’s disarming demeanor and thick German accent combined with a quirky intellectual charisma may convince some involved with WEF that they are among the chosen ones — members of a cultish elite vanguard that is being empowered to save the world.

How much attendees really buy into the WEF agenda is hard to know. But Schwab becomes most animated — calling it a source of immense pride — when he specifically refers to his “penetration of governments,” citing that some half the cabinets of the prime ministers and presidents of Canada, Argentina and France are now graduates of the WEF Young Global Leaders Program. Pete Buttigieg, the current Secretary of Transportation in the Biden administration is also attending training sessions with the Young Global Leaders Program.

In the first year of the COVID-19 outbreak, Schwab said that “the COVID pandemic represents a rare but narrow window of opportunity to reflect, reimagine, and reset our world to create a healthier, equitable, and more prosperous future.”

To achieve that collectivist environmental social justice vision, WEF has become a major player in politicizing the flow of funds and investment dollars through the development of a corporate behavior credit score system based on subjective criteria pertaining to real or perceived environmental, social and governance standards, known as ESG — with ESG standing for Environmental, Social, and Governance.

To be fair, it was the United Nations (that also happens to have many interlocking programs with WEF) that originated the ESG concept in 2005 for the ostensible purpose of promoting more environmentally friendly and sustainable investment. It was a short step from getting recognition for the ESG acronym to creating modeling for evaluating and scoring public companies based on their output as it pertained to environmental and sustainability criteria.

The anti-corporate pro-socialist left that has been around for more than 50 years was quick to recognize how ESG could help their agenda. Today WEF’s internal International Business Council oversees a program, “Shaping the Future of Investing,” that may be the most far-reaching and influential program of its kind, having created a coalition of more than 100 partners, including companies, policymakers, asset managers, pension funds and insurance companies, to drive consensus on investment reforms that address global challenges.

The WEF International Business Council’s ESG initiative has also provided an avenue to bring the world’s largest accounting firms into the fold, providing Deloitte, Ernst and Young, KPMG and PricewaterhouseCoopers with an expanded set of measurements to change reporting criteria to integrate financial with other woke nonfinancial criteria, such as greenhouse gas emissions, gender equality and compensation practices. All of which means higher compliance costs to corporations and more money for the lawyers and accountants.

Larry Fink is the chairman and chief executive officer of BlackRock Inc., which is now the world’s largest investment management corporation with over $10 trillion under management. Also, a WEF Trustee and member of its International Business Council, Fink has been an open supporter of the Great Reset movement’s use of ESG criteria.

One ESG model developed by the International Business Council with Fink playing an important role evaluates businesses based on their commitment to the Paris Climate Accords, water use, “ecological sensitivity,” and the “percentage of employees per employee category, by age group, gender and other indicators of diversity.” In 2021 Fink claimed that “everything we do” will be affected by ESG scores within five years.

When the assets of the four largest American investment management firms that embrace ESG — that is Vanguard, Fidelity, and State Street Bank are added to the assets of BlackRock, there is effective control of some 30% of the votes of the companies in the S&P 500. And since ESG has become a major force behind voting based on stockholdings, it should come as no surprise that many public companies, which had previously been apolitical, now align themselves with the woke values and issues of left-wing elites.

We all remember in March of 2021 when Coca-Cola and Delta Airlines — two of the largest employers in Georgia — reflexively and loudly protested the passage of the state’s modest election reform law — the most controversial part of which required voter IDs.

What is of great concern is how China is gaining in incremental influence and control over American companies, the flow of funds and the way our economy works. The New York Times reported in late July 2021 at the height of Chinese market turmoil, that China’s securities regulator, Fang Xinghai met with BlackRock, Goldman Sachs and other U.S. based investment management companies to enlist their help to alleviate investor nervousness over Beijing’s crackdown on e-commerce and social media, including the detention of Alibaba boss Jack Ma and the deplatforming of superstar actress Vicki Zhao.

After that meeting, CCP officials made a deal with BlackRock and Fidelity that allowed them to offer investment products and services in China. And shortly thereafter, BlackRock recommended in the Financial Times and to their clients that investors increase their China investment exposure by two or three-fold.

Politicization of economies invariably leads to corruption and misallocation of resources. And when a venue such as ESG benefits investors in certain companies in politically favored industries and penalizes investors in out of favor industries, resulting in the elite rich getting richer while diminishing the middle class, a correction is needed. ESG appears to facilitate a new form of elitist regulatory socialism that benefits the rich, the wheel of which turns in one direction like a ratchet.

It is also a national security risk and a bridge too far when American investment company proponents of ESG can strike deals in a hostile country like China and then carry the water for the CCP in some quid-pro-quo pay-back.