Wealth & Poverty Review Gilder Fellows Seminar a Virtual Success

"GilderFest" Survives the Pandemic at the Center for Wealth and Poverty's Annual Gilder Fellows Seminar Originally published at Gilder PressFor the last several days, I’ve been in Seattle, in the belly of the coronabeast.

During my runs up Queen Anne’s hill, I kept meeting furtive people in masks scurrying to the side of the road as I approached, in the belief I might be emitting a deadly effluence of infected aerosols on the Seattle breezes.

Just over the hill from CHAZ and CHOP, near the heart of the COVID-19 catastrophe, I was at Discovery Institute to teach my new economics. Tuning in from around the world were Gilder Fellows. From Nigeria to Japan, they gathered and gabbed on Zoom, which gave me hope that I might also have been reaching interested auditors in the Chinese government.

As many people now know, Zoom is the meteoric Silicon Valley video telephony company that has alarmed Senators and Congressmen by harboring 700 R&D coders in subsidiaries in Suzhou, China. Zoom had a rarely lucrative IPO on NASDAQ in April last year and made many Americans rich, which makes American politicians nervous these days.

Founded by Eric Yuan who swiveled out of Cisco with a team of 40, Zoom rose from obscurity to become the preferred means of communication under COVID, with a market cap miracle worth $69 billion and a price earnings ratio of 1,363.

According to US intelligence officials, any Chinese company is mandated to provide aid to Chinese spies. With its Chinese connections and data centers — similar to the Chinese links of most US technology companies — Zoom and other Chinese affiliated firms are attracting much hostile attention from US trade warriors. Thus, AT&T turned off service to my Huawei phone and left me unable to reach my crucial Uber and Lyft aps during my recent trip through Silicon Valley. In my ignominy, I was forced to hire cabs and pay in cash.

I rather hope the Chinese government listened in to me, since they could benefit a lot from my information theory of economics, which outlines a new model of capitalism that transcends the definition supplied by Karl Marx.

In Das Capital, which appeared in three volumes between 1852 and 1900, Marx actually named the system “capitalism” and depicted it as driven by greed and exploitation. Actuated by an incentive scheme of rewards and punishments — as if Jeff Bezos needs his some-100 billions of share ownership as motivation to go to work — the existing capitalist model offers no telling refutation of Marx and the greed theory of wealth.

I explained to my students that capitalism is not an incentive system, driven by carrots and sticks, but an information system, driven by knowledge and learning. Recently publishing a Chinese version of Wealth & Poverty and naming Life After Google the best social science book of the year in China, the Chinese seem interested in learning how free markets actually work.

Some people called it GilderFest, but I was more impressed with the other Discovery Institute fellows. I was blown away by Gale Pooley’s demonstration that time-prices are the only true prices and his proof that a growing population spurs abundance. He calculates that every 1% increase in population has been accompanied by a 4% increase in abundance.

As I have been pointing out, the only thing that remains relatively scarce when everything else grows abundant is time. Pooley endorsed my thesis that money is essentially tokenized time.

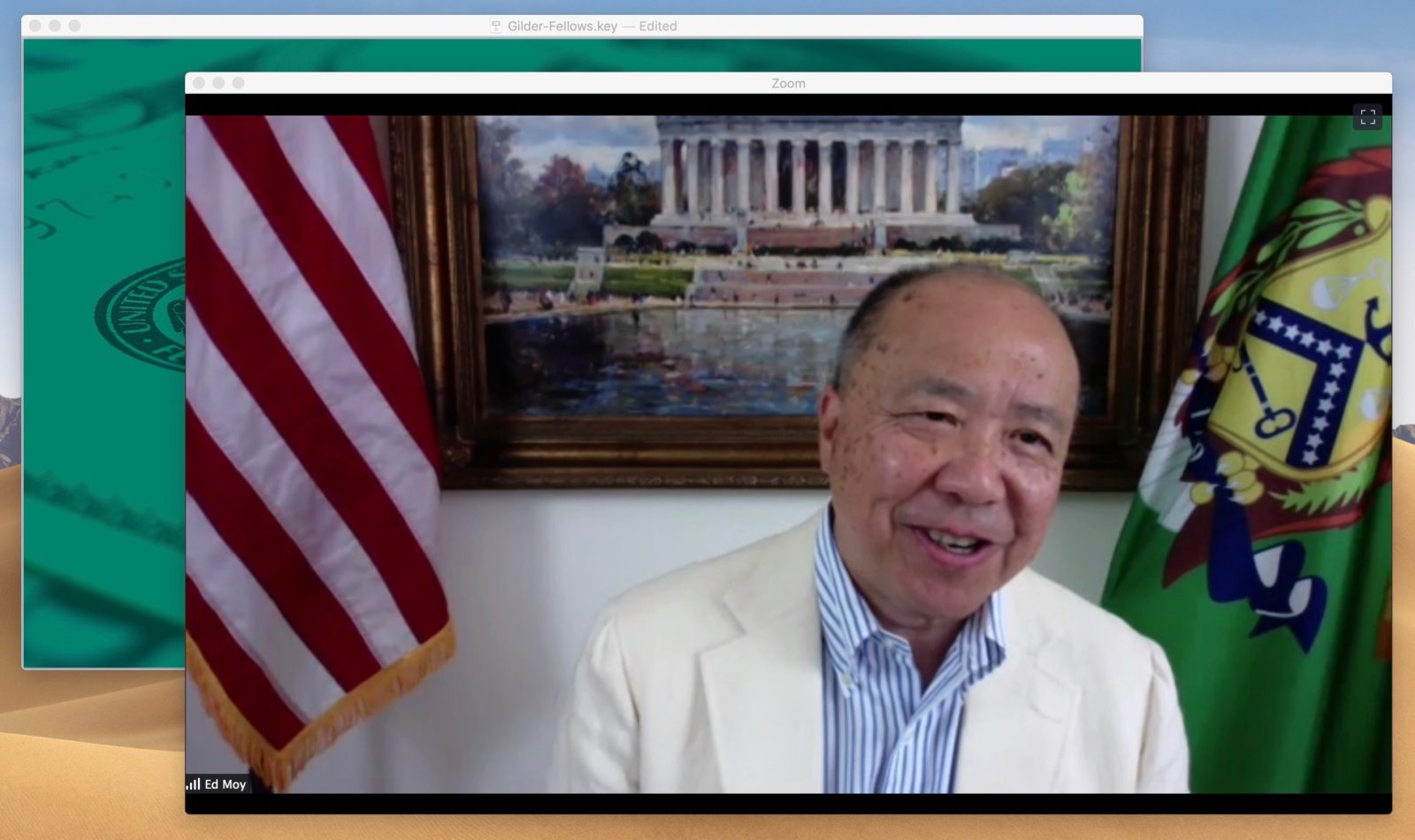

I relished Ed Moy explaining the scandal of money and telling of how his father reacted to his ascent to his post as Director of the US Mint: “At last you are going to make some real money.”

“If only,” I said, ruefully remarking on the Fed’s fiat follies, and the $6.7 trillion per day of currency trading, rising 30% in three years while trade stopped growing. When money itself is the largest and perhaps most profitable capitalist industry, some 25 times larger than world GDP, we are moving to “Life After Capitalism.”

I was much impressed also by fiery Fox star Christopher Rufo and his insights into homelessness and the welfare bureaucracy. He told us that the National Aeronautics and Space Agency (NASA) reportedly paid some $500,000 to a leftist apparatchik to teach a course to its employees titled “Power and Privilege: Sexual Orientation Workshop.” The leftist hustler also received some $3.5 million to teach “Critical Race Theory” to other branches of the government.

The climax of the day was Jay Richards, documenting the utter failure of the COVID lockdowns in his new book, The Price of Panic, out in October, and written with former Cornell statistician William Briggs and eminent biologist Douglas Ax. He showed that not only did the lockdowns wreak economic devastation but they produced absolutely no benefits in fighting the disease.

He compared states and countries according to the dates of their lockdown orders. If the lockdowns were effective, there would be a signature in the data bending the curve some 10 days after the closures. But a graph of all the data showed no sign whatsoever of any benefits. As a similar study in Israel revealed, the progress of the disease was unaffected by the government’s actions. But some 50 million people lost their jobs and the Federal debt was engorged with a $2 trillion rescue package.

Since the government itself caused the damage, it made sense for the government to act. But the ballooning of unemployment payments actually retarded recovery from the crisis.

Criticizing the closing of schools, Richards also pointed out that people under 17 were 20 times more likely to die of the flu than of COVID-19 and that deaths from COVID or “with COVID” came at an average age of 82, higher than the average age of all deaths.

Even testing has become counterproductive. Now approaching a million tests a day, across the population, the inevitable false positives and false negatives may actually outnumber the actual symptomatic COVID cases. My colleague John Schroeter of Moonshots has just published his own best-selling COVID e-book on Kindle titled COVID-19: A Devil’s Choice, How We Got Here and How We’ll Get Out. Now suing Washington Governor Jay Inslee for his mask order, Schroeter gives a devastating account of this greatest policy blunder in American history.

However, all of us are beginning to get co-morbid about the bizarre viral new mania. We have to get beyond it back into the world of technology.

Represented on the second day of GilderFest by the phenomenal biotech entrepreneur Matt Scholz with three breakthrough companies, technology holds the answer to many of our ills. An advocate of the information theory of biology, Scholz launched Immusoft to build a system for programming DNA to turn the body into a factory making its own needed drug molecules. His Oisin is devoted to combating aging with gene therapy, and OncoSenX is fighting cancer. Scholz even offers the possibility of a COVID vaccine in a pill. I will tell his amazing story in a future Prophecy.