Archives

George Gilder | Life After Capitalism on the Eric Metaxas Radio Show

Life After Capitalism

Life After Capitalism

The information theory of economics

Doomed to Succeed

On Doom: The Politics of Catastrophe by Niall Ferguson.

Gold, Currency Trading, and Stealing Time

Gilder Fellows Seminar, 2021

Gaming AI

Why AI Can't Think but Can Transform Jobs

George Gilder, Wealth & Poverty 40 Years Later

We Need Politicians in a Pandemic

The conceit that everyone must bow to ‘science’ is not only undemocratic but dangerous in its own right.

The Simon Abundance Index

A New Way to Measure Availability of Resources

Three Steps to Save America from Collapse

Huawei Is an Asset, Not a Threat

Ren Zhengfei’s company should be celebrated as a triumph of the U.S.-led global trading system.

The Creativity of Capitalism and the Post-Google Era

Steve Forbes Podcast with George Gilder

Google Does Not Believe in Life After Google

The Ten Laws of Google versus the Ten Laws of the Cryptocosm

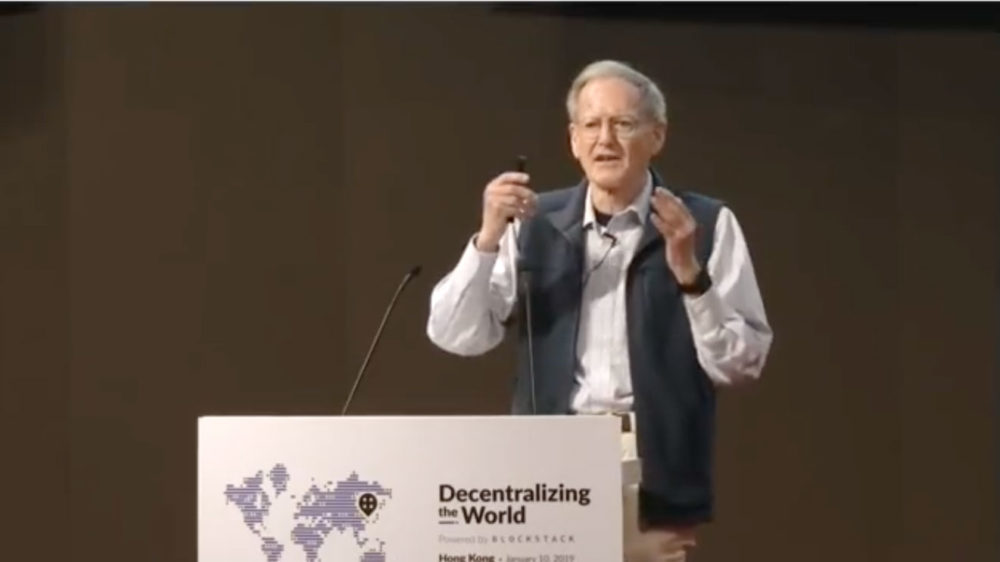

George Gilder Discusses Life After Google at Decentralizing the World in Hong Kong

Forget Cloud Computing, Blockchain is the Future

George Gilder Interview with Peter Robinson

Life After Google